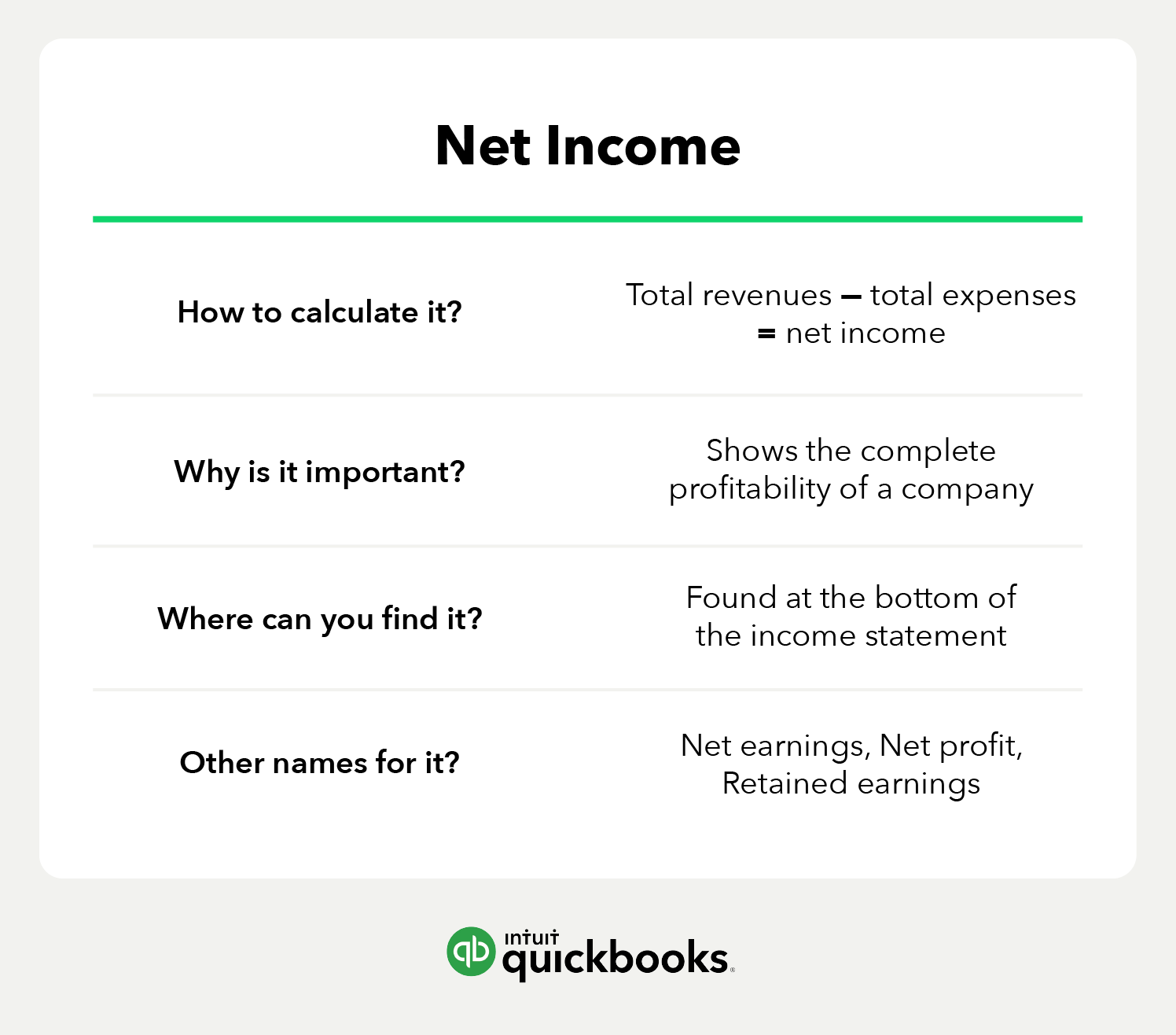

EBITDA, on the other hand, will differ from operating income as operating income deducts depreciation and amortization expense. Another way to calculate income from operations is to start at the bottom of the income statement at Net Earnings and then add back interest expense and taxes. This is a common method used by analysts to calculate EBIT, which can then be used for valuation in the EV/EBIT ratio. This measures how using too much or too little in direct material affects total costs.

Which of these is most important for your financial advisor to have?

Since service companies don’t produce goods, the COGS is replaced by the cost of revenue, which is essentially the COGS for service companies. Operating income is often confused with earnings before interest and taxes (EBIT). CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation.

Indirect Costs

Linda wants to understand if her business is profitable after deducting all the costs of running it. Operating income represents the profit a company has after paying for all expenses related to core operations. Below is a complete guide to operating income, including examples and how it compares to other measures of profit. In almost all cases, operating income will be higher than net income because net income often deducts more expenses than operating income.

Example of Operating Profit

When looking at a company’s financial statements, revenue is often the highest level of financial reporting. Because operating income deducts less expenses than net income, it is usually a higher calculated amount. When you combine the formula for net income with total cost, you arrive at another formula that shows you how volume affects profits.

- Operating profit is one metric that is used to determine a company’s profitability from its core operations.

- Let us consider an example to calculate EBIT for a company called ABC Limited, which manufactures customized roller skates for both professional and amateur skaters.

- All of our content is based on objective analysis, and the opinions are our own.

- When the operation income generated is higher, it shows the managerial flexibility in the company.

- Operating income is a reflection of a company’s ability to convert its expenses into profits through efficient allocation of its resources.

- Analysts use operating income to calculate essential financial ratios, such as the operating margin.

How is Operating Income calculated?

From the example above, gross profit was $700,000 for the period, achieved by subtracting $150,000 in COGS from the revenue of $850,000. Therefore, it took a hit to its operating income for a couple of quarters to rapidly expand its network. The red ink on its operating income figures in the income statement may not tell you that story.

Cost of goods sold

Gross income takes the total revenue a company has accumulated from its various revenue streams and subtracts the cost of goods sold or sales costs from it. It provides a clear picture of a company’s ability to generate profits from its core operations, making it a vital tool for investors and analysts. Understanding and interpreting operating income is essential for making informed financial decisions in today’s complex and dynamic marketplace.

Apart from the knowledge of the profits, you can deduce the risk factor in taking loans to expand the business or take on a big project. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Management is well aware of this fact and can try to fraudulently change the ratio by accelerating revenue recognition or delaying the recognition of expenses.

Considering what it entails, you can tell that a lot of merits are attached to it. For better understanding, let’s look at the financial report (fictional) of a company. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Bill’s Sandwich Shop makes some of the best subs and grinders in the Philadelphia area.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Each serves a purpose in understanding different aspects of the company’s profitability. Ultimately, investors should also assess cancelled debt net or bottom-line profits, in addition to operating income. The biggest non-operating expense items are taxes and interest, but there’s also a category called “other (non-operating) income or expenses.” Gross profit is helpful in understanding the direct costs required to produce the goods that have been sold.